In the financial industry, access to accurate and real-time data is paramount. Whether you’re making investment decisions, analyzing market trends, or assessing the financial health of companies, data plays a crucial role. However, manually collecting and processing this data can be an overwhelming and time-consuming task. This is where web scraping comes in—automating the extraction of valuable financial data from the web, providing businesses with the insights they need for smarter decision-making.

In this article, we will explore the growing importance of web scraping for financial data analysis, the key benefits of automating data extraction, and how financial institutions can leverage this technology for a competitive edge.

What Is Web Scraping, and How Does It Work in Financial Data Analysis?

Web scraping is a technique used to automatically extract large amounts of data from websites. This process involves using software tools that mimic human behavior—such as navigating websites, copying, and pasting content—to gather information directly from web pages. For financial institutions, web scraping can collect vast amounts of structured and unstructured data, which can then be used for market analysis, stock trading, and investment decision-making.

In financial data analysis, web scraping can be used to gather information from various sources, including stock exchanges, company websites, financial reports, social media, and news platforms. The goal is to extract relevant data in real-time, enabling financial professionals to make data-driven decisions based on the latest market trends and economic factors.

The Importance of Automating Financial Data Extraction

The finance sector generates and relies on vast amounts of data from a wide array of sources. Collecting and processing this information manually is not only time-consuming but can also lead to errors and missed opportunities. Automated data scraping solves this problem by providing real-time data at scale, saving valuable time and resources.

Some of the primary reasons why financial institutions should consider implementing automated web scraping solutions include:

- Speed and Efficiency: Web scraping can collect data from multiple sources simultaneously, delivering up-to-date information in a fraction of the time it would take to gather it manually.

- Real-Time Access: With web scraping, financial professionals can access the latest market data, stock prices, and news, which is crucial for timely decision-making.

- Cost-Effective: Automating data collection reduces the need for manual labor, freeing up valuable resources that can be invested elsewhere in the business.

- Accuracy and Consistency: Unlike manual data entry, which is prone to human error, web scraping ensures that the extracted data is consistent and error-free.

Key Data Sources for Financial Web Scraping

There are several types of data that can be collected through web scraping in the financial industry. These include both structured data, like financial statements and market prices, and unstructured data, such as news articles and social media sentiment. Here are some common data sources for financial web scraping:

- Stock Market Data: Web scraping tools can gather real-time stock prices, trading volumes, historical data, and other relevant market information, providing a comprehensive view of the stock market.

- Company Financials: Web scraping can be used to collect financial statements, earnings reports, and other key metrics directly from company websites or investor relations pages.

- News and Social Media Sentiment: Scraping financial news websites, blogs, and social media platforms allows companies to track public sentiment, identify market-moving events, and gain insights into how global news impacts stock performance.

- Alternative Data: This includes non-traditional financial data such as customer reviews, supply chain information, and data from private companies. These data sets can offer valuable insights into market trends and investment opportunities.

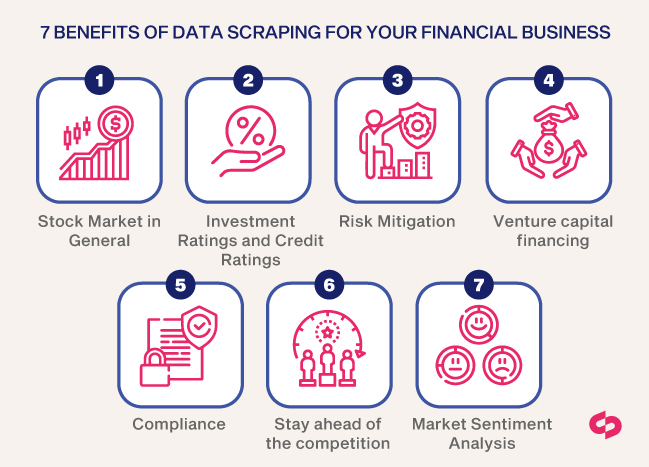

7 Key Benefits of Using Web Scraping for Financial Data Analysis

Web scraping offers numerous benefits that help financial institutions make smarter investment decisions and optimize their market strategies. Here are seven key advantages of using web scraping for financial data analysis:

1. Stock Market Insights

For investors and analysts, monitoring market trends is essential to making informed decisions. Web scraping allows the collection of stock prices, market news, and company performance data, all of which help in spotting patterns and identifying profitable investment opportunities. Continuous access to real-time data ensures that investors can make decisions quickly in response to market fluctuations.

2. Investment and Credit Ratings

Financial institutions use web scraping to aggregate data from multiple sources to evaluate potential investments. By gathering company data, public financial records, and performance metrics, scraping tools can help generate accurate investment ratings and credit scores. This data-driven approach provides a more accurate picture of a company’s financial health, enabling investors to assess the risk of potential investments.

3. Risk Mitigation and Management

Risk assessment is critical in finance, and web scraping plays a vital role in risk mitigation. By collecting data from multiple sources, financial institutions can analyze the potential risks of different investments, evaluate market volatility, and identify assets that offer the best risk-to-reward ratio. The ability to continuously monitor these risks allows businesses to make informed decisions and reduce exposure to financial losses.

4. Venture Capital and Startups

In the world of venture capital and startup investment, web scraping can help identify emerging companies and trends. By scraping data from popular venture capital websites, financial firms can uncover funding rounds, track startup valuations, and discover opportunities in untapped industries. With over 25,000 million web pages scraped annually for investment purposes, this data is invaluable for uncovering market niches and identifying high-potential investment opportunities.

5. Regulatory Compliance and Legal Considerations

Web scraping helps financial institutions stay compliant with local regulations and industry standards. Scraping tools can monitor government websites, news platforms, and social media for updates on financial regulations, tax policies, and legal changes. This ensures that financial firms are always informed of relevant compliance requirements and can avoid costly penalties.

6. Competitive Intelligence

To stay ahead in a competitive market, financial professionals need access to the most current market data. Web scraping enables companies to gather competitor information, including pricing strategies, market share, and product offerings. This information helps businesses make informed decisions, allowing them to maintain a competitive edge in a rapidly evolving market.

7. Market Sentiment Analysis

Web scraping tools can collect data from news outlets, social media platforms, and financial blogs to assess market sentiment—the overall mood or perception of the financial market. By analyzing consumer sentiment, investors can gauge the potential success of certain stocks, predict market movements, and make more informed predictions about asset performance.

Scraping Pros: A Trusted Partner in Financial Data Scraping

At Scraping Pros, we specialize in providing customized web scraping solutions for businesses in the financial sector. Our expertise allows us to deliver accurate, real-time data tailored to your specific needs. With over 15 years of experience, we offer scalable solutions that help businesses collect, store, and analyze financial data more efficiently.

Some of the key benefits of working with Scraping Pros include:

- Improved Efficiency: Our automated web scraping service streamlines the process of data collection, saving time and reducing costs.

- Personalized Data Delivery: We tailor data extraction solutions to meet the specific needs of each client, ensuring you get the right data at the right time.

- Expertise and Experience: With our world-class technical capabilities and industry knowledge, we provide high-quality, reliable data for financial analysis.

- Scalability: Our services can handle large-scale data scraping projects, ensuring that your business can scale as needed.

- Real-Time Data: We deliver up-to-the-minute data to keep your business competitive and informed.

- Competitive Intelligence: Our solutions provide insights into competitor strategies and market trends, helping you stay ahead of the curve.

Conclusion: Embrace the Future of Financial Data Analysis with Web Scraping

In the fast-paced world of finance, having access to accurate, real-time data is essential for success. Web scraping offers financial institutions the ability to automate data extraction, analyze vast amounts of information, and make data-driven decisions quickly. By leveraging web scraping for financial data analysis, companies can gain a competitive advantage, optimize investment strategies, and improve risk management.Interested in optimizing your financial data analysis? Contact Scraping Pros to discover how our tailored web scraping solutions can help you achieve smarter, more informed investment decisions.