How Web Scraping Fuels Growth in the Banking and Insurance Sectors

In today’s fast-paced, data-driven world, financial institutions such as banks and insurance companies are increasingly relying on web scraping to gather crucial insights from vast amounts of online data. Web scraping for banking and insurance can provide an edge in improving customer understanding, automating key processes, and driving better decision-making in an industry that thrives on information.

In this article, we will explore how web scraping is revolutionizing data collection in the banking and insurance industries, and why it’s becoming an indispensable tool for companies seeking to stay ahead of the competition.

The Role of Web Scraping in the Financial Sector

Web scraping refers to the process of automatically extracting data from websites using bots or scripts. It allows businesses to access vast amounts of publicly available data from various online sources, including social media, competitors’ websites, forums, and financial platforms, in a structured format that is ready for analysis.

For banking and insurance industries, web scraping offers the opportunity to scale their data collection efforts while maintaining accuracy, efficiency, and cost-effectiveness. By utilizing web scraping, banks can gain better insights into customer behavior, risk analysis, and even market trends—critical areas that can help drive their strategic decisions.

Regulatory Considerations for Web Scraping in Banking and Finance

Before diving into the benefits, it’s important to understand the regulatory landscape that governs web scraping in the banking and finance sectors. As data privacy and security remain top priorities for these industries, it’s essential that web scraping efforts comply with legal standards.

Australia and Europe: Legal Precedents

Globally, discussions have occurred around the legality of web scraping, especially when it comes to financial data. For instance, the Australian Senate investigated the issue and concluded that advanced web scraping does not pose significant risks to the financial system. This stance was reinforced when the Committee for Financial Technology and Technological Regulation rejected a ban on web scraping, allowing it as a legitimate tool for banks.

In Europe, regulations such as PSD2 (Revised Payment Services Directive) have brought changes to the financial landscape. PSD2 mandates that banks provide secure APIs to third-party providers, but there are limitations in the scope of data that these APIs offer. While APIs generally cover basic banking services, they don’t provide the full spectrum of financial data necessary for a comprehensive view of customers’ financial health. In these cases, web scraping becomes an essential complement to APIs, enabling banks to gather more data beyond just checking account information.

Open Finance: The Future of Data Sharing

With the implementation of PSD2, the concept of Open Banking has paved the way for a broader financial ecosystem where financial data can be securely shared between banks, fintechs, and other third-party providers. However, open finance, which aims to expand beyond basic banking details to include savings, investments, and credit data, is still in its infancy.

Web scraping plays a critical role in this transition by allowing third-party providers to gain access to a more complete set of financial data, with user consent. By logging into customers’ financial accounts, with their permission, these providers can retrieve valuable data that enables them to offer tailored financial products, assess risk more effectively, or provide personalized advice.

For instance, financial services firms can use web scraping to access data from various online sources, such as credit card statements or investment portfolios, to offer more targeted services like personalized loan offers or insurance policies.

Web Scraping for Insurance: Unlocking Market Insights

Web scraping is also proving to be a game-changer for the insurance industry. By gathering data from various online sources, insurance companies can uncover insights that would otherwise be time-consuming or difficult to obtain.

How Insurance Companies Leverage Web Scraping

Insurance companies use web scraping to access vast amounts of publicly available data, helping them in several key areas:

- Market Research and Competitor Analysis: Insurance companies can scrape competitor websites to analyze pricing models, new policies, or special offers, allowing them to adjust their strategies accordingly.

- Risk Assessment: Web scraping helps insurance providers collect data on potential clients from multiple online sources, helping them to assess risk more accurately. This is especially important when underwriting policies or determining premiums based on customer behavior.

- Sentiment Analysis: Web scraping tools can monitor social media platforms, news articles, and forums to analyze consumer sentiment. Insurance companies can use these insights to gauge how their customers perceive their services or products, allowing them to make adjustments quickly.

- Claims Processing: Scraping data from customer reviews or complaint boards can assist insurance companies in detecting trends or issues that might indicate fraud or operational weaknesses, enabling them to refine claims processing methods.

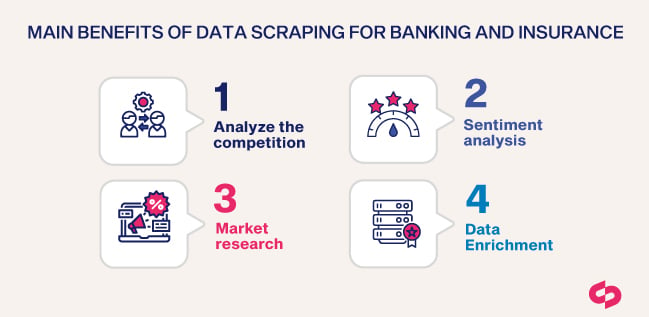

Main Benefits of Web Scraping for Banking and Insurance

1. Improved Customer Insights

For both banking and insurance sectors, understanding customer behavior is paramount. Web scraping enables companies to gather data on purchasing behavior, browsing habits, and social media interactions, which can be used to create detailed customer profiles. With a better understanding of customers’ needs, companies can provide more personalized services, whether it’s recommending relevant insurance products or offering tailored loan options.

2. Enhancing Risk Assessment and Credit Scoring

Web scraping helps banks and insurance companies access a broader range of financial data, such as income levels, spending habits, and outstanding debts. This allows them to refine credit scoring models and better evaluate risk. For example, scraping data from various sources, including utility payments or rental history, can provide a more comprehensive view of an individual’s financial stability, helping banks to make more informed lending decisions.

3. Market Research and Competitive Intelligence

Banks and insurance companies can gain a competitive edge by using web scraping to monitor competitors’ pricing, marketing campaigns, and customer sentiment. This real-time market intelligence can guide strategic decisions and ensure that companies remain agile in a fast-changing marketplace. Moreover, analyzing trends in consumer preferences can help organizations develop more effective products and services that meet current market demand.

4. Data Enrichment for Decision-Making

Web scraping allows organizations to enrich their internal datasets by integrating external data sources. By combining internal customer data with insights gathered from the web, companies can build more robust models for predictive analysis, improve customer segmentation, and refine marketing strategies.

5. Improved Operational Efficiency

The automation of data collection through web scraping reduces the need for manual processes, saving time and resources. Banks and insurance companies can use this time to focus on more strategic activities, such as improving customer service, optimizing product offerings, and driving innovation.

Why Choose Scraping Pros?

At Scraping Pros, we specialize in providing tailored web scraping solutions for the banking and insurance sectors. Our team of experts can help you automate data collection, ensuring that your business has access to high-quality, structured data that is ready for analysis. We offer:

- Customized Solutions: We understand that each organization has unique data needs. Our team will work with you to design a web scraping strategy that aligns with your specific goals.

- Compliance: We ensure that all our scraping practices are ethical and comply with local regulations, so you can confidently access the data you need without legal concerns.

- Scalability: Whether you’re a small fintech startup or a large financial institution, we offer scalable solutions to meet your data requirements.

By partnering with Scraping Pros, you can unlock the full potential of your data and stay ahead of the competition.

Conclusion

Web scraping has become an indispensable tool for the banking and insurance industries, enabling companies to automate data collection, improve customer insights, and stay competitive in a rapidly evolving market. By leveraging the power of web scraping, financial institutions can streamline operations, improve risk assessment, and deliver more personalized services to their customers. If you’re looking to integrate web scraping into your business, consider working with a trusted partner like Scraping Pros to unlock the full value of your data.

Explore our web scraping services and see how we can help your business thrive in the data-driven future.