Accurate Financial

Data Extraction

Extract, analyze, and automate financial data from contracts, statements, and reports with our industry-leading financial data extraction services. Make smarter decisions, faster.

Reliable Financial Data collection

Fully Managed Financial Data Extraction

Stop spending hours gathering and structuring financial data—we handle it all for you. Simply tell us what data you need, and our service extracts, processes, and delivers it in a structured format.

Get accurate, ready-to-use financial insights without the hassle.

1. Tell us what to extract

Specify the financial data sources you need—reports, stock prices, filings, market data, or others.

2. We collect & process the data

Our fully managed service extracts, cleans, and structures the financial data with high accuracy.

3. Receive ready-to-use data

Get the extracted data delivered in a structured format like CSV, Excel, or JSON.

4. Scale with seamless integration

Easily integrate financial data into your systems for analysis, forecasting, or decision-making.

Why choose our financial data extraction?

Accurate & fully managed data solutions

Focus on insights, not data collection. Our fully managed financial data extraction service ensures fast, accurate, and compliant data delivery—without any technical effort on your part.

Data extraction, done right

No tech skills needed, we handle everything for you—from customizing your web scrapers to data delivery—so you get exactly what you need. With us, your data flows smoothly, no matter the scale.

We build custom solutions tailored to your specific industry, data points, and requirements

Whether you need CSV, JSON, XML, or direct API integration, we deliver your data on schedule.

You get a dedicated account manager who understands your business and ensures smooth operations.

Our unique technology and adaptive scraping techniques keep your data flowing without interruptions.

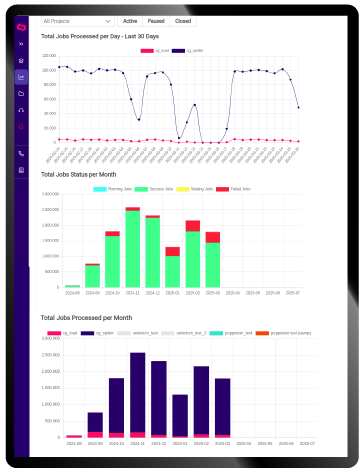

Real results,

measurable Impact

Our fully managed financial data extraction solutions help businesses save time, cut costs, and drive better decisions.

%

reduction in manual efforts

%

data accuracy guaranteed

financial reports processed monthly

Get started

Start monitoring your competitors’ pricing strategies.

Leverage web data for smarter decisions

Access crucial financial data with ease using our financial data extraction service. Focus on analysis while we handle the data extraction process, ensuring you stay compliant and informed.

Fraud Detection

Use extracted data to identify anomalies and prevent fraud.

Competitor Analysis

Extract financial data from competitors’ reports to identify market trends.

Risk Management

Automate extraction of financial contract data to assess risks and compliance.

Investment Research

Scrape financial statements and reports for real-time investment insights.

Regulatory Compliance

Extract and analyze data to ensure compliance with financial regulations.

Customer Insights

Scrape financial data to understand customer behavior and preferences.

The #1 Choice for Reliable Web Scraping

Proven, rated, trusted.

Clients worldwide

Data Sources Scraped

★ Rated 5/5

Your Data, Your Way.

Tell us what data you need—we’ll handle it for you. With custom solutions, ban-resistant technology, and seamless integration, Scraping Pros delivers trusted, high-quality data without the headaches.

Join 50+ businesses and get started today!

Fast setup: Tell us what you need, and we’ll handle everything.

Free data sample: Get a preview of your data before committing.

Get in touch!

Everything You Need to Know About Financial data collection

Got questions? We’ve got answers.

From custom solutions to anti-ban technology, find answers to the most common questions about how Scraping Pros delivers reliable, secure, and scalable data extraction for your business.

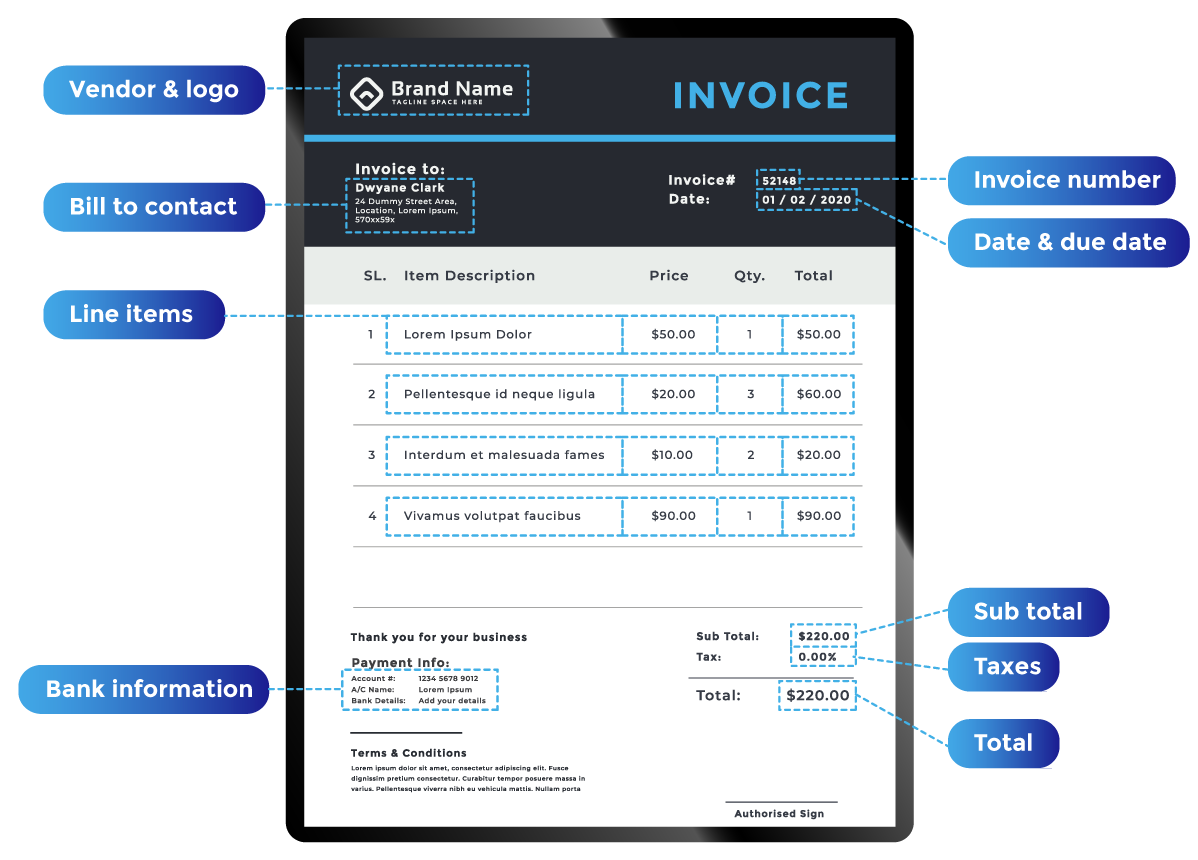

What is financial data?

Financial data includes information from contracts, statements, reports, and other documents used for decision-making.

How to extract financial data?

Our tools and services automate extraction from contracts, statements, and PDFs, delivering clean, structured data in minutes.

How to analyze financial data?

Use our platform to visualize trends, identify insights, and generate reports effortlessly.

How data analytics can help financial reporting?

Analytics transforms raw data into actionable insights, improving accuracy and efficiency in financial reporting.

How financial companies are using big data to prevent fraud?

By analyzing patterns and anomalies in financial data, companies can detect and prevent fraudulent activities.

How do you stay up to date on financial news?

Our tools scrape real-time data from trusted sources, ensuring you always have the latest insights.

How to protect financial data?

We use encryption, access controls, and compliance with GDPR/CCPA to ensure data security.